The Urban Development Ministry has shelled out Rs 7,637 crore towards

metro rail projects in five states and the national capital in the

current financial year till November, Lok Sabha was informed today.

Naidu said during the Question Hour that various measures are being taken to improve public transport and parking spaces in various cities.

In the current fiscal till November, the Ministry spend Rs 7,636.98 crore for metro rail projects in the national capital and five states -- Tamil Nadu, Karnataka, Maharashtra, Kerala and Gujarat, he said.

For Delhi, the expenditure stood at Rs 4,160.82 crore and for the project in Chennai, it touched Rs 1,773.59 crore, the Minister said.

He said the Ministry's expenses towards Bangalore project (Karnataka) stood at Rs 857.97 crore.

For the metro rail projects in Kochi (Kerala) and Ahmedabad (Gujarat), the expenditure till November stood at Rs 599.08 crore and Rs 100 crore, respectively

In Maharashtra, there are metro rail projects in Mumbai and Nagpur. For Mumbai project, an expenditure of Rs 108.52 crore has been incurred by the Ministry till this November, while for the Nagpur project, the expense stood at Rs 37 crore during the same period.

According to the Minister, metro rail projects are implemented in partnership with the states.

To a query about the fourth phase of Delhi Metro Rail project, Naidu said the proposal is pending with the Delhi government. Source: Times of India

After

witnessing sliding profits over the past three years, the residential

real estate market is in desperate need of a stimulus to revive the

sector.

While the government’s decision to relax the foreign direct investment norms in real estate last month is expected to play a critical role in addressing the concerns on the supply side, the recommendations of the Seventh Central Pay Commission is being termed a potential game changer on the demand side. The pay panel proposes a hefty salary and pension hike for Central government employees and pensioners.

According to experts, with the real estate market burdened with a large volume unsold inventory, just removing the supply-side bottlenecks won’t help as the lack of demand will keep the markets under pressure. However, the demand might witness a surge as a higher disposable income in the hands of a substantial chunk of the population might just motivate investment in residential property.

A report prepared by Neelkanth Mishra, Prateek Singh and Ravi Shankar of Credit Suisse says that the Pay Commission recommendations will have a significant impact on the real estate cycle in small towns as more than 80 per cent of Central government employees reside in tier II, III cities.

The Pay Commission boost

The report analysing the impact of the recommendations point out that as state governments and Central PSUs follow through the CPC (recommended hike of 23.6 per cent) proposals, almost 3.4 crore individuals (employees and pensioners) will witness increase in their incomes. The housing and transportation sectors will be the biggest beneficiaries of the rise in income and spending capacity of government employees.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.

According to Credit Suisse, out of the total state and central employees, the 6O lakh, who will see around Rs 24,000 salary increase per month, are likely to be instrumental in lifting the housing sector demand.

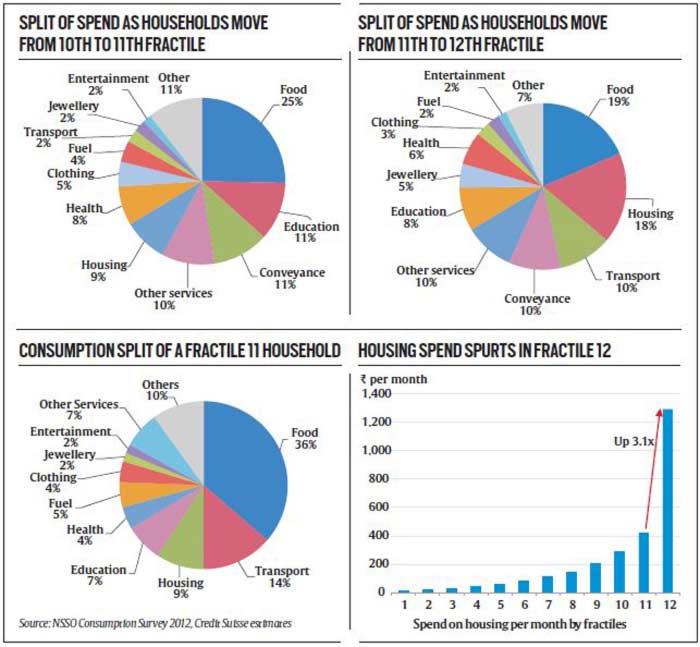

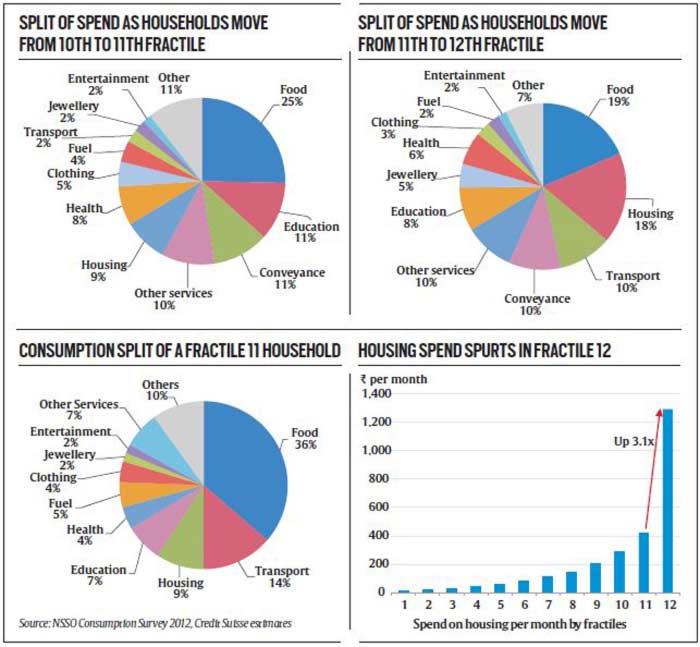

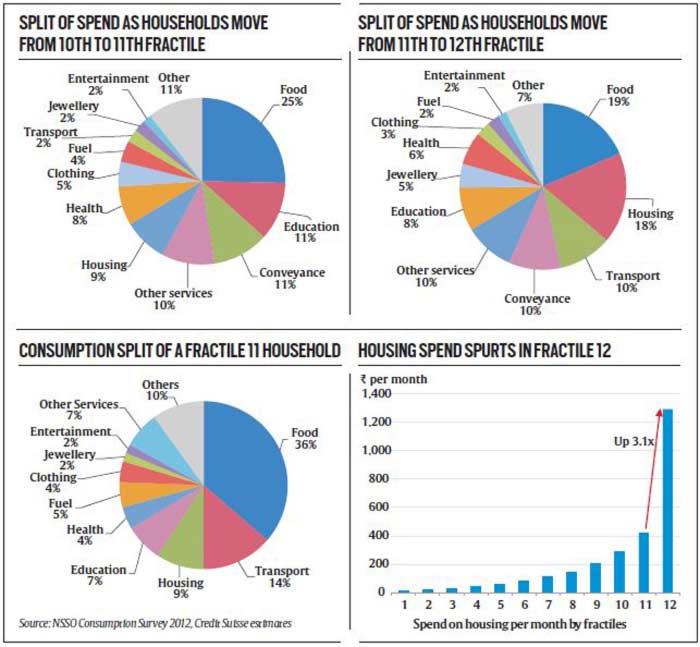

The National Sample Survey Organisation (NSSO) classifies the country’s population into 12 classes (fractiles) demarcated by monthly per capita income.

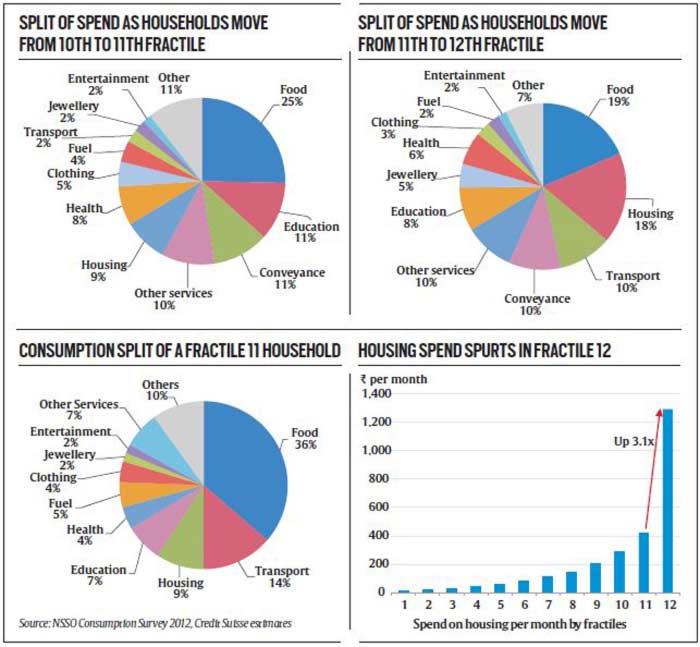

The report states that while spending on food and transportation goes up the most when disposable incomes rise for those between the 10th and 11th fractiles, it also pointed to the fact that as households move from the 11th to the 12th fractile (8.3 per cent of households), the spend on rent rises 3.1 times and there is a similar impact on home ownership too.

“Most of this impact is likely in the smaller cities (only 20 per cent of central government employment is in the tier I cities). The Pay Commission recommendation, in our view, is an important milestone in the real-estate cycle in the smaller towns, recent weakness was likely the effect of the last pay commission fading,” said the Credit Suisse report.

While the Centre may take six months in implementing the recommendations, a 3-5 per cent higher increase than recommended would take the hike in the comprehensive wage bill to Rs 4.5-4.8 lakh crore which is expected to be spread over a period of two years starting from June 2016 as states and Central PSUs take their decisions. “We estimate 75 per cent of the increase should occur in FY17, and the rest in FY18,” said the report.

While the report says that impact on housing and real estate will be substantial and lift demand, there are some who feel that the benefits may not be huge.

“I think the Pay Commission recommendations will also be inflationary so the actual benefit that may come to employees may only be around 10 per cent as against a hike of 23.5 per cent. And if the developers decide to increase the price then it would be a dampener,” said Samantak Das, chief economist & national director, Knight Frank India.

The supply side effect

While the government had, in 2005, eased the foreign direct investment norms for real estate sector and allowed 100 per cent FDI in townships, housing and built-up infrastructure and construction developments, it had imposed certain conditions.

However, with ambitious targets like ‘Housing for All’ and Smart Cities in the pipeline, what the government needs is a thriving real estate market and thus, in November, the Centre decided to do away with some of the restrictive conditions.

While the earlier policy required a minimum of 20,000 square meters of development and a minimum capital of $5 million, the government has now removed those conditions and it is expected that these will result into higher investment flow into city-centric developments where the condition of 20,000 square metres was a dampener.

Along with this, the need to bring in investment within six months of commencement of the project has also been removed.

Das, however, said that FDI will not flow in till the time demand for residential housing picks up as investors will only come if the market is good.

“While the office market has picked up, residential market is expected to take at least 12 more months to pick up. The market is still full of unsold inventory and till the time it gets absorbed, the sector will remain weak,” said Das.

While the government’s decision to relax the foreign direct

investment norms in real estate last month is expected to play a

critical role in addressing the concerns on the supply side, the

recommendations of the Seventh Central Pay Commission is being termed a

potential game changer on the demand side. The pay panel proposes a

hefty salary anddwrwerfwetwepension hike for Central government employees and

pensioners.While the government’s decision to relax the foreign direct investment norms in real estate last month is expected to play a critical role in addressing the concerns on the supply side, the recommendations of the Seventh Central Pay Commission is being termed a potential game changer on the demand side. The pay panel proposes a hefty salary and pension hike for Central government employees and pensioners.

According to experts, with the real estate market burdened with a large volume unsold inventory, just removing the supply-side bottlenecks won’t help as the lack of demand will keep the markets under pressure. However, the demand might witness a surge as a higher disposable income in the hands of a substantial chunk of the population might just motivate investment in residential property.

A report prepared by Neelkanth Mishra, Prateek Singh and Ravi Shankar of Credit Suisse says that the Pay Commission recommendations will have a significant impact on the real estate cycle in small towns as more than 80 per cent of Central government employees reside in tier II, III cities.

The Pay Commission boost

The report analysing the impact of the recommendations point out that as state governments and Central PSUs follow through the CPC (recommended hike of 23.6 per cent) proposals, almost 3.4 crore individuals (employees and pensioners) will witness increase in their incomes. The housing and transportation sectors will be the biggest beneficiaries of the rise in income and spending capacity of government employees.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.According to Credit Suisse, out of the total state and central employees, the 6O lakh, who will see around Rs 24,000 salary increase per month, are likely to be instrumental in lifting the housing sector demand.

The National Sample Survey Organisation (NSSO) classifies the country’s population into 12 classes (fractiles) demarcated by monthly per capita income.

The report states that while spending on food and transportation goes up the most when disposable incomes rise for those between the 10th and 11th fractiles, it also pointed to the fact that as households move from the 11th to the 12th fractile (8.3 per cent of households), the spend on rent rises 3.1 times and there is a similar impact on home ownership too.

“Most of this impact is likely in the smaller cities (only 20 per cent of central government employment is in the tier I cities). The Pay Commission recommendation, in our view, is an important milestone in the real-estate cycle in the smaller towns, recent weakness was likely the effect of the last pay commission fading,” said the Credit Suisse report.

While the Centre may take six months in implementing the recommendations, a 3-5 per cent higher increase than recommended would take the hike in the comprehensive wage bill to Rs 4.5-4.8 lakh crore which is expected to be spread over a period of two years starting from June 2016 as states and Central PSUs take their decisions. “We estimate 75 per cent of the increase should occur in FY17, and the rest in FY18,” said the report.

While the report says that impact on housing and real estate will be substantial and lift demand, there are some who feel that the benefits may not be huge.

“I think the Pay Commission recommendations will also be inflationary so the actual benefit that may come to employees may only be around 10 per cent as against a hike of 23.5 per cent. And if the developers decide to increase the price then it would be a dampener,” said Samantak Das, chief economist & national director, Knight Frank India.

The supply side effect

While the government had, in 2005, eased the foreign direct investment norms for real estate sector and allowed 100 per cent FDI in townships, housing and built-up infrastructure and construction developments, it had imposed certain conditions.

However, with ambitious targets like ‘Housing for All’ and Smart Cities in the pipeline, what the government needs is a thriving real estate market and thus, in November, the Centre decided to do away with some of the restrictive conditions.

While the earlier policy required a minimum of 20,000 square meters of development and a minimum capital of $5 million, the government has now removed those conditions and it is expected that these will result into higher investment flow into city-centric developments where the condition of 20,000 square metres was a dampener.

Along with this, the need to bring in investment within six months of commencement of the project has also been removed.

Das, however, said that FDI will not flow in till the time demand for residential housing picks up as investors will only come if the market is good.

“While the office market has picked up, residential market is expected to take at least 12 more months to pick up. The market is still full of unsold inventory and till the time it gets absorbed, the sector will remain weak,” said Das.

According to experts, with the real estate market burdened with a

large volume unsold inventory, just removing the supply-side bottlenecks

won’t help as the lack of demand will keep the markets under pressure.

However, the demand might witness a surge as a higher disposable income

in the hands of a substantial chunk of the population might just

motivate investment in residential property.

A report prepared by Neelkanth Mishra, Prateek Singh and Ravi Shankar of Credit Suisse says that the Pay Commission recommendations will have a significant impact on the real estate cycle in small towns as more than 80 per cent of Central government employees reside in tier II, III cities.

The Pay Commission boost

The report analysing the impact of the recommendations point out that as state governments and Central PSUs follow through the CPC (recommended hike of 23.6 per cent) proposals, almost 3.4 crore individuals (employees and pensioners) will witness increase in their incomes. The housing and transportation sectors will be the biggest beneficiaries of the rise in income and spending capacity of government employees.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.

According to Credit Suisse, out of the total state and central employees, the 6O lakh, who will see around Rs 24,000 salary increase per month, are likely to be instrumental in lifting the housing sector demand.

The National Sample Survey Organisation (NSSO) classifies the country’s population into 12 classes (fractiles) demarcated by monthly per capita income.

The report states that while spending on food and transportation goes up the most when disposable incomes rise for those between the 10th and 11th fractiles, it also pointed to the fact that as households move from the 11th to the 12th fractile (8.3 per cent of households), the spend on rent rises 3.1 times and there is a similar impact on home ownership too.

“Most of this impact is likely in the smaller cities (only 20 per cent of central government employment is in the tier I cities). The Pay Commission recommendation, in our view, is an important milestone in the real-estate cycle in the smaller towns, recent weakness was likely the effect of the last pay commission fading,” said the Credit Suisse report.

While the Centre may take six months in implementing the recommendations, a 3-5 per cent higher increase than recommended would take the hike in the comprehensive wage bill to Rs 4.5-4.8 lakh crore which is expected to be spread over a period of two years starting from June 2016 as states and Central PSUs take their decisions. “We estimate 75 per cent of the increase should occur in FY17, and the rest in FY18,” said the report.

While the report says that impact on housing and real estate will be substantial and lift demand, there are some who feel that the benefits may not be huge.

“I think the Pay Commission recommendations will also be inflationary so the actual benefit that may come to employees may only be around 10 per cent as against a hike of 23.5 per cent. And if the developers decide to increase the price then it would be a dampener,” said Samantak Das, chief economist & national director, Knight Frank India.

The supply side effect

While the government had, in 2005, eased the foreign direct investment norms for real estate sector and allowed 100 per cent FDI in townships, housing and built-up infrastructure and construction developments, it had imposed certain conditions.

However, with ambitious targets like ‘Housing for All’ and Smart Cities in the pipeline, what the government needs is a thriving real estate market and thus, in November, the Centre decided to do away with some of the restrictive conditions.

While the earlier policy required a minimum of 20,000 square meters of development and a minimum capital of $5 million, the government has now removed those conditions and it is expected that these will result into higher investment flow into city-centric developments where the condition of 20,000 square metres was a dampener.

Along with this, the need to bring in investment within six months of commencement of the project has also been removed.

Das, however, said that FDI will not flow in till the time demand for residential housing picks up as investors will only come if the market is good.

“While the office market has picked up, residential market is expected to take at least 12 more months to pick up. The market is still full of unsold inventory and till the time it gets absorbed, the sector will remain weak,” said Das.

- See more at: http://indianexpress.com/article/india/india-news-india/7th-pay-commission-fresh-hope-for-realty-demand/#sthash.Mvokk8X7.dpuf

A report prepared by Neelkanth Mishra, Prateek Singh and Ravi Shankar of Credit Suisse says that the Pay Commission recommendations will have a significant impact on the real estate cycle in small towns as more than 80 per cent of Central government employees reside in tier II, III cities.

The Pay Commission boost

The report analysing the impact of the recommendations point out that as state governments and Central PSUs follow through the CPC (recommended hike of 23.6 per cent) proposals, almost 3.4 crore individuals (employees and pensioners) will witness increase in their incomes. The housing and transportation sectors will be the biggest beneficiaries of the rise in income and spending capacity of government employees.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.

“Altogether

around 80 per cent of the beneficiaries would see an increase of less

than Rs10,000 per month and account for 50 per cent of the payout. The

rest would get around Rs 24,000 more every month on an average,” said

the report.According to Credit Suisse, out of the total state and central employees, the 6O lakh, who will see around Rs 24,000 salary increase per month, are likely to be instrumental in lifting the housing sector demand.

The National Sample Survey Organisation (NSSO) classifies the country’s population into 12 classes (fractiles) demarcated by monthly per capita income.

The report states that while spending on food and transportation goes up the most when disposable incomes rise for those between the 10th and 11th fractiles, it also pointed to the fact that as households move from the 11th to the 12th fractile (8.3 per cent of households), the spend on rent rises 3.1 times and there is a similar impact on home ownership too.

“Most of this impact is likely in the smaller cities (only 20 per cent of central government employment is in the tier I cities). The Pay Commission recommendation, in our view, is an important milestone in the real-estate cycle in the smaller towns, recent weakness was likely the effect of the last pay commission fading,” said the Credit Suisse report.

While the Centre may take six months in implementing the recommendations, a 3-5 per cent higher increase than recommended would take the hike in the comprehensive wage bill to Rs 4.5-4.8 lakh crore which is expected to be spread over a period of two years starting from June 2016 as states and Central PSUs take their decisions. “We estimate 75 per cent of the increase should occur in FY17, and the rest in FY18,” said the report.

While the report says that impact on housing and real estate will be substantial and lift demand, there are some who feel that the benefits may not be huge.

“I think the Pay Commission recommendations will also be inflationary so the actual benefit that may come to employees may only be around 10 per cent as against a hike of 23.5 per cent. And if the developers decide to increase the price then it would be a dampener,” said Samantak Das, chief economist & national director, Knight Frank India.

The supply side effect

While the government had, in 2005, eased the foreign direct investment norms for real estate sector and allowed 100 per cent FDI in townships, housing and built-up infrastructure and construction developments, it had imposed certain conditions.

However, with ambitious targets like ‘Housing for All’ and Smart Cities in the pipeline, what the government needs is a thriving real estate market and thus, in November, the Centre decided to do away with some of the restrictive conditions.

While the earlier policy required a minimum of 20,000 square meters of development and a minimum capital of $5 million, the government has now removed those conditions and it is expected that these will result into higher investment flow into city-centric developments where the condition of 20,000 square metres was a dampener.

Along with this, the need to bring in investment within six months of commencement of the project has also been removed.

Das, however, said that FDI will not flow in till the time demand for residential housing picks up as investors will only come if the market is good.

“While the office market has picked up, residential market is expected to take at least 12 more months to pick up. The market is still full of unsold inventory and till the time it gets absorbed, the sector will remain weak,” said Das.

- See more at: http://indianexpress.com/article/india/india-news-india/7th-pay-commission-fresh-hope-for-realty-demand/#sthash.Mvokk8X7.dpuf

While

the Centre’s easing of FDI norms last month was a positive development

on the supply front, a new report says that the pay panel’s

recommendations will provide a much-needed boost to the demand side. -

See more at:

http://indianexpress.com/article/india/india-news-india/7th-pay-commission-fresh-hope-for-realty-demand/#sthash.Mvokk8X7.dpuf

No comments:

Post a Comment